I have been engaged in international trade and foreign exchange trading for 30 years and have been thinking about the technical obstacles of economic globalization at the international settlement level. The Balance of Payments rules that the trade surplus countries end up with debts of trade deficit countries, and under the multilateral free trade system, the international settlement has become extremely complicated.

The Balance of Payments Principle:

Current Account Balance = Financial Account Balance + Foreign Exchange Reserves

The Balance of Payments Principle determines that if the left side of the equation is deficit, the right side of the equation will be external debt. If the left side of the equation is surplus, the right of the equation will be international financial claims. Deficit countries usually fail to settle the debt owed to surplus countries. Regardless of whether the US dollar is an international settlement currency or Renminbi is not a free flowing currency, the Balance of Payments always applies. International trade is settled twice, first between traders, then the currency conversion between countries. Even if the United States trade in dollar, its external debt is still a foreign debt, and the US Dollar, while enjoying the status of an international settlement currency, cannot escape the rule of Balance of Payments. That’s why Buffett said: With long-term persistent trade deficit, the United States will eventually become a colony of the creditors!

This is a problem Western economics has not solved in 300 years. Three years ago, I finally came upon a solution entirely from the technical perspective. Gaming with real data of 2017, it worked. Addressing the dollar dilemma, I hope my work will lead to the establishment of a new world trade currency system step by step.

(1) The Dollar Dilemma

Assessing whether the US-led globalization and the dollar system they designed is good or bad for the US, we need to start from the “Balance of Payments” (see Annex 1: U.S. Balance of Payments)

The Balance of Payments Principle:

Current account balance = Financial account balance + Foreign exchange reserve

From 1960, the United States has built a cumulative trade and service deficit of US $ 11.5 trillion, with a net international investment income of US $ 3.27 trillion, and personal remittance + government international expenditure of US $ 2.37 trillion. This means, in the past 59 years, the cumulative global profit return of American companies minus the return of profit to foreign investors, has resulted in a total net profit of 3.27 trillion US dollars. This income minus the personal remittance + government’s overseas expenditure of 2.37 trillion US dollars amounted to non-trade net income of 900 billion US dollars. This 900 billion income is not even close to trade off the 11.5 trillion trade deficit. Therefore, the entire nation’s running depends on increasing foreign debt. The cumulative increase in external debt is $ 11 trillion over the past 59 years! The public generally believes that although the United States has deficit in trade, American companies have made a fortune in globalization. This statement has no fact support at all.

The fact is the US-run international monetary system, centered on the US dollar, is maintained by the United States’ increasing foreign debt. As of September 2019, the global foreign exchange reserves were US $ 11 trillion, and the US net foreign debt was also US $ 11 trillion. From a global perspective, the global foreign exchange reserves have filled the black hole of US debt.

Why is this obvious problem not ringing global alarm? Because mainstream economists believe this is the basis of the Triffin Paradox.

(2) The Triffin Paradox

Mr. Triffin argues that external debt is a necessary condition for the dollar to become a reserve currency. Money flows freely around the world, and savings of trade surplus countries naturally go to trade deficit countries, because if surplus countries’ financial institutions don’t convert traders’ gained dollars to local currency, these traders will not be able to continue reproduction. Therefore, trade surplus countries become trade deficit countries’ creditors, while the latter accumulates foreign debt. Mr. Triffin argues that if reserve currency countries need to absorb global savings, it’s only natural that trade deficit countries’ currencies should become global reserve currencies because only these countries need to borrow debt. As a result, trade surplus countries such as China and Japan naturally cannot become reserve currency states. This is the so called the Triffin Paradox. Call it a paradox because everyone knows that logic doesn’t work. The international trade settlement is the core of international financial stability, and this settlement is based on a paradox! This cannot go on. Supported by this paradox, the US foreign debt has put US economy in great danger.

The public is not alarmed because people believe the US government could print money to pay off their foreign debt.

(3) The US. Cannot Print Money to Pay Off Its Foreign Debt

Can the U.S. really evade paying debts? Let’s take a look at how deep the liquidity of global financial system is.

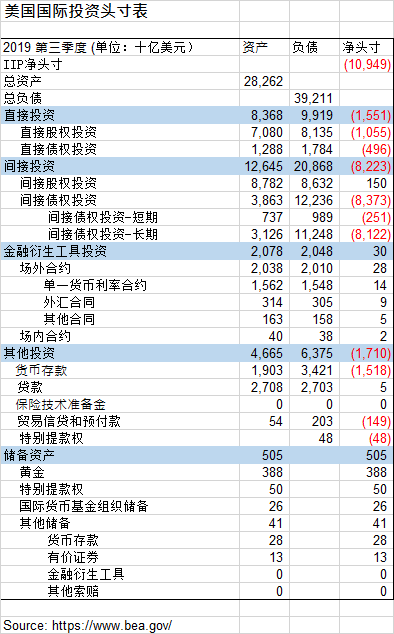

The United States has $39 trillion external debt, $28 trillion total external assets, meaning $11 trillion deficit in International Investment Position. (See Annex 2: Table of U.S. International Investment Positions)The Eurozone has total assets of EUR 28 trillion and total liabilities of EUR 28 trillion. (See Annex 3: Eurozone International Investment Position Table). The combined gross national income of these two economies is only $32 trillion. If there is any sign that US would default its debt, more than $70 trillion financial assets under the control of Wall Street in Europe and the US would be exposed to risk. The foreseeable scenario could be that the dollar’s selling pressure surging like a flood, tumbling the global financial system instantly. Comparing to the impact of dollar debt default on the global financial system, the collapse of Lehman would be less than nothing! The dollar debt default would be catastrophic while all the major European and American banks going bankrupt. So, it’s easy to say that the US can evade paying debts, while in practice, it’s not an option.

Another entrenched view of the public is that if the US cannot evade paying debts, it can start the money printing machine!

Although the US. owes US dollar debt, creditors still have to sell dollars if the Fed starts the money-printing machine to pay off its debt. For example, the Fed prints money to pay off its debt to China, the Fed buys US dollar debt, and China sells US. debt which is reflected in foreign exchange trading. China sells US $1 trillion to buy the equivalent of other currencies. The question is, China sells dollars, who is going to buy them? If the Fed buys dollars, what currency does the Fed sell? America’s foreign exchange reserves is almost zero, so the Fed can’t sell a non-dollar currency it doesn’t have, right? The Balance of Payments Rules!.It’s that simple!

The Fed doesn’t have any foreign exchange reserves, and when other countries sell dollars, the Fed simply can’t intervene in the foreign exchange market. Without intervention in the currency market, no dollar buyer can be found. That’s why I always say that the dollar has no self protection back up plan. The dollar stability depends entirely on international creditors’ confidence in dollar. When the market confidence vanishes, nobody can save dollar except for its creditors. The US Dollar is America’s strongest suit and its Achilles’ Heel.

Advantage: Because theUS dollar is the international settlement currency, American companies borrow in US. dollars, and run import and export without the risk of exchange rate fluctuation. Without exchange rate fluctuation risk, enterprises in the global competition has a profit margin of about 10%. A competitive edge of 10% profit is decisive. Therefore, American companies are more profitable and more competitive than those of Europe, Japan and China. The US dollar being an international settlement currency is indispensable.

Weakness The US is a long-term deficit country with a total external debt of $39 trillion, of which $22 trillion is financed in bonds, funds and stock markets. Under normal market circumstances, America’s financial market liquidity is fine. However,once a unilateral market is in place, all the market liquidity will be gone over night. The collapse of Lehman in 2008 was a perfect example showing how vulnerable the market liquidity can be. When the dollar crisis comes, nothing can save the market. So the premise of dollar working effectively is that it always has enough liquidity, and this conclusion is based on the assumption that the dollar will not have a unilateral market. When the one-sided market comes, the dollar doesn’t have any self protection mechanism. America’s $11 trillion net foreign debt is the biggest threat to its national economic security.

(4) Why Does the Floating Exchange Rate System Inevitably Fail?

The current US Dollar system and the Triffin Paradox theory is based on the floating exchange rate system, and the past 60 years have proven that this system does not work.

First, it usually takes a country 5-10 years to establish an industrial chain, while the operating cycle of the floating exchange rate is getting shorter and more unpredictable. The floating exchange rate is losing the regulative power to balance trade. Moreover, the competitiveness of import and export is composed of many factors, and trade rebalance cannot be achieved by relying soly on exchange rate changes.

For example, to assess whether the RMB is overvalued or undervalued, if you look at property price, the Chinese Yuan is overvalued; if you look at the wages of ordinary workers and prices of basic necessities, the RMB has a big room for appreciation. Moreover, a country’s welfare system is also a key factor affecting its international competitiveness. For example, an average American earns an annual income of $40,000, but his living quality is no better than an Italian or a Spanish earning $20,000. This is because Americans bear higher costs of education, health care, and urban management. America’s living cost is the highest in the world. These factors all have an impact on a country’s international competitiveness.

Second, how major economies deal with the flaw of the floating exchange rate puts us in a global perspective.

Western economists believe that trade imbalance can be regulated by exchange rate fluctuation, so their balance of payment equation is:

Current account balance = Financial account balance

In practice, Asian trade surplus countries such as China and Japan adopted countermeasures to maintain domestic reproduction by establishing the foreign exchange reserves, while Germany integrated the Eurozone at all costs. The goal was to help the currency market achieve equilibrium of currency transactions. Therefore, the Balance of Payments equation evolved to:

Current account balance = Financial account balance + Foreign exchange reserves

The foreign exchange reserves has helped trade surplus countries to balance the foreign exchange transactions and to stabilize reproduction. In the mean time, it has ruined the adjusting function of the floating exchange rate.

The United States often labels trade surplus countries as exchange rate manipulators, while in fact, it’s a complete pseudo proposition. The $11 trillion global foreign exchange reserves is indeed the result of government intervention. Without government intervention in the foreign exchange market, there will be no foreign exchange reserves at all. The global foreign exchange reserves is $11 trillion, America’s net foreign debt is $1.1 trillion, this shows that the US. economy relies on global foreign exchange reserves to move on. Without global foreign exchange reserves, the dollar may have collapsed long ago. Global foreign exchange reserves plays a vital role in dollar stability. So we must crack the Triffin Paradox when we design the new international settlement currency system.

(5) Triffin Paradox Can Only Be Solved with Offshore Currencies Operating Independently

The current international monetary system is still a variant of barter trade. Whether in Europe and the United States, which pursue market-determined exchange rates, or in China and Japan, which intervene in foreign exchange markets, or at WTO established for the multilateral free trade system, so far, economists around the world have not resolved the settlement problem arised from trade imbalance. Trade surplus countries cannot achieve actual settlement with trade deficit countries. In practice, trade balance is rare and trade imbalance is common. Under the multilateral trade system, this problem becomes more complicated.

The dollar’s external debt problem is not only US economy’s biggest threat, but also the biggest danger to global financial stability. The economic globalization has been undergoing for 300 years, and gold, silver or today’s dollar settlement currency all failed to solve the settlement problem resulted from trade imbalance. Looking back at the major financial crises, the reasons behind were always related to trade imbalance. The economic motive of the British and other Western powers launching the Opium War against the Qing Dynasty was also the British trade deficit with the Qing Dynasty. Deficit countries’ gold and silver went to surplus countries, which led to the depletion of gold and silver in deficit countries.

In 1971, the dollar got rid of the shackles of gold, but it’s still under the rule of Balance of Payments. The United States has accumulated as much foreign debt as trade deficit. The new monetary system of international trade must tackle this 300 year problem. My plan is: onshore and offshore currencies should run completely independent of each other. The international settlement and reserve currency should not participate in the circulation of domestic currency. Only in this way, can we avoid the dollar dilemma, thus cracking the Triffin Paradox.

(6) The New International Reserve Currency System

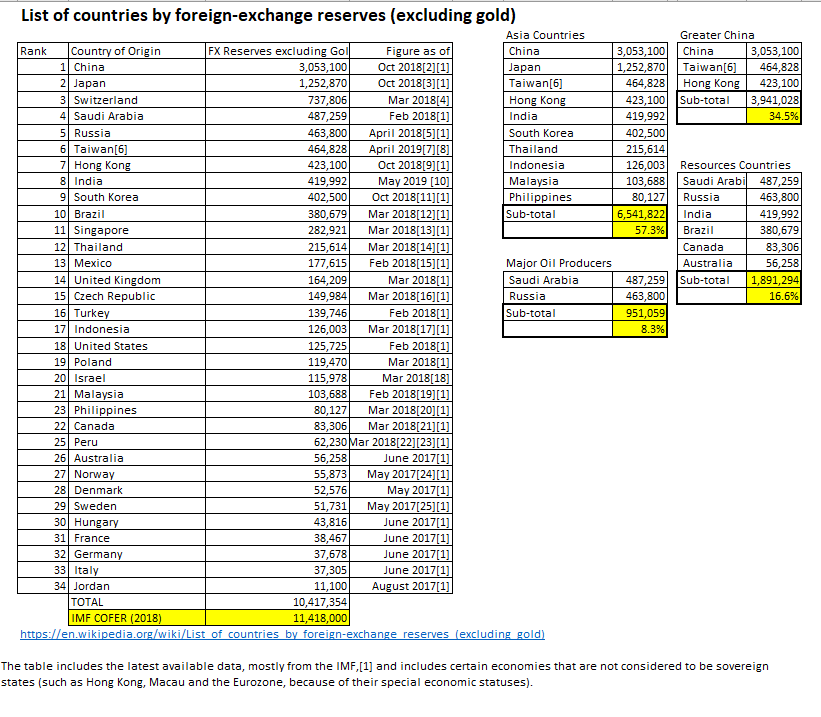

To solve the dollar problem, the international reserve currency must be independent from any sovereign state currency, and the global foreign exchange reserves must endorse the global clearing currency. At present, 60% of the global foreign exchange reserves comes from Asia, of which 34% from the Greater China economic circle, and 17% comes from raw material suppliers, 8.3% comes from oil suppliers. A careful analysis of these trade surpluses shows that 85% of the export demand for foreign exchange reserves comes from China (see Annex 4: Global Foreign Exchange Reserve Distribution).

From 2000 to 2018 , China accumulated a trade deficit of US$8 trillion with raw material countries and producers of high-tech products ( see Annex 5: China’s import and export trade ) , which means that countries with trade surpluse with China earned foreign exchange from China and deposited it mainly in US dollars. China’s foreign exchange reserves also come from trade surplus with the United States. In one word, the bulk of foreign exchange reserves outside China and Japan is contributed by China’s purchasing power. Therefore, the so-called petrol dollar is no longer true. Countries with foreign exchange reserves together should work out a plan for the new global trade settlement and reserve currency.

I name the new international settlement and reserve currency the Global Yuan, independent of any sovereign state currency. Founding states of the Global Yuan can join the new Global Yuan Central Bank with their foreign exchange reserves. Their respective investment will decide their voting power and equity interests. The Global Yuan is not any country’s domestic clearing currency. This can technically solve the problem that surplus countries cannot manage international reserve currencies. SDRs cannot be implemented because SDRs have nothing to do with global trade. The new international settlement currency can only take root when it serves world trade. The SDRs system must be reformed to attract countries with foreign exchange reserves to be share holders in the new central bank, so that the new currency could serve world trade.

In short, the Global Yuan will replace the US dollar to function as the international trade settlement currency and international credit, and the Global Yuan will become a pool of global foreign exchange reserves. The Global Yuan is endorsed by participating states’ foreign exchange reserves. It does not have the right to print money. It is like any commercial bank to make ends meet when it comes to international credit business. The Global Yuan Central Bank can use credit leverage to support economic growth and promote trade rebalance. This will fundamentally solve the settlement problem caused by trade imbalance, while boosting global economic growth.

The Global Yuan will put an end to the 300 year international settlement problem originated from economic globalization. With the new currency system for international trade, the global foreign exchange reserves will benefit the people of the world, and in the mean time, bring long-term stable return to participating countries and investors.

(7)With Global Foreign Fxchange Reserves Reaching Ceiling, the US Trade Deficit Keeps Growing , A Red Light for Dollar Indeed!

Balance of Payments:

Current account balance = Financial account balance + foreign exchange reserves

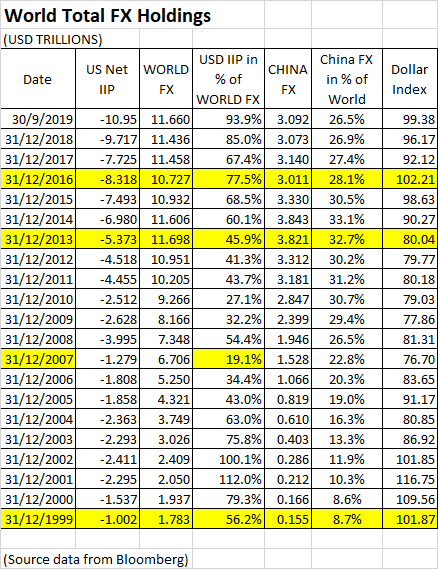

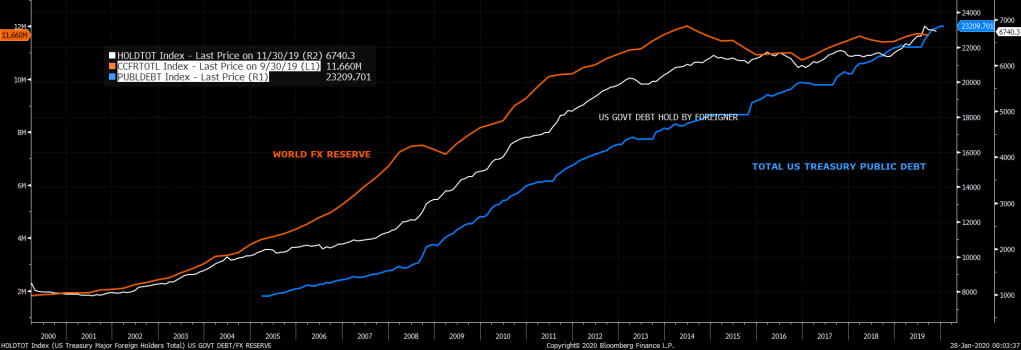

Financial capital inflows into the dollar are unstable sources of funding and the rising foreign exchange reserves is the cornerstone of dollar stability. The U.S. net foreign debt accounted for 19% of global foreign exchange reserves in 2007, and today it’s 93%. (see Annex 6: Global Foreign Exchange Reserves vs. Net Foreign Debt of the United States).

Data shows that since 2007, the continued growth of global foreign exchange reserves has been the umbilical cord for US dollar. Now, the global foreign exchange reserves has reached ceiling, but the US foreign debt is still growing. (see Annex 7: U.S. debt vs global foreign exchange reserves) The Dollar can no longer rely on global foreign exchange reserves to maintain its stability. The US. dollar is about to face the risk of a broken capital supply chain! The world has to be prepared for the coming up dollar crisis.

Annex 1

Annex 2

Annex 3

Annex 4

Annex 5

Annex 6

Annex 7

CV of the Author

Born in June 1959 in Tianjin China, Margaret Ma volunteered to be a peasant in Inner Mongolia in1976. During her stay in the rural area, She read “On Capital” by Karl Marx. In 1977, she passed the national college entrance exam and studied in Inner Mongolia Food Institute, accounting major.

From 1980 to 1987, she worked in an agency under Tianjin Municipal Planning Committee, in charge of large state enterprises’ foreign exchange loans conversion to RMB through trade. In 1993, she quitted the job and began to do import and export of bulk commodities. In 2000, she immigrated to Australia and became an independent investor.

Persistent reflection on futures helped Margaret develop a keen insight in the basics of exchange rate fluctuation. Margaret is now studing Balance of Payments in hopes of providing technical support for the new world trade settlement currency system.